Blockchain technology has created significant waves in the fintech global market. Its acclaim has risen from 2018 to 2022, with multiple banks in North America and Europe energetically exploring its possible applications. During this period, financial institutions put approximately $552 million worldwide into blockchain projects.

But what exactly is blockchain technology, and how will its application change the scenery of banking and finance? This blog aims to provide clear and brief answers to these questions, supporting your company’s entry into fintech blockchain solutions. Here, we will display numerous blockchain use cases influencing the global financial sector.

Before delving into the transformative strength of blockchain in finance, it’s essential to introduce the idea of fintech first.

Discover how fintech blockchain solutions can reform your finance operations from our blockchain strategy professionals. Have a free session with Sky Potential US now!

What Is Financial Technology (Fintech)?

“Fintech, short for financial technology, encompasses innovative technologies that aim to enhance and automate the distribution and usage of financial services. It performs a crucial role in allowing entrepreneurs, businesses, and individuals to oversee their financial operations and overall financial well-being effectively. Fintech relies on specialized software and algorithms, which are reachable via computers and smartphones.

Initially, fintech primarily focused on the backend systems of established financial institutions, like banks, when it emerged in the 21st century. However, from around 2018 to 2022, there was a notable shift towards consumer-centric services. This evolution has expanded the scope of fintech to encompass various sectors and industries, combining nonprofit organizations, education, fundraising, retail banking, and investment management, among others.

Additionally, fintech is synonymous with the development and usage of cryptocurrencies like Bitcoin. Although the cryptocurrency sector garners significant attention, the most significant financial possibilities still reside within the conventional global banking industry, characterized by its multitrillion-dollar marketplace capitalization.

What is blockchain technology? And how it delivers a new path to the world of financial services.

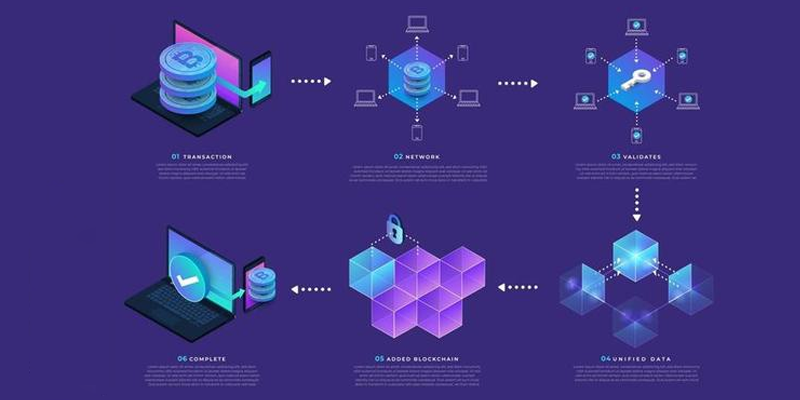

Blockchain technology, a sophisticated data management system, relies on intricate cryptography to enable multiple cryptocurrencies and decentralized applications at its core; blockchains function as accounting systems and digital ledgers that facilitate auditing. Their distinctiveness from traditional databases lies in their ability to disseminate real-time ledger data updates to all network-connected devices, rendering data alteration nearly impossible, as the network devices must collectively accept any proposed changes akin to a voting process.

The inception of blockchain was exemplified by Bitcoin, a pioneer in the digital currency realm, providing decentralized funds transfers without reliance on a primary authority like a traditional primary bank. Bitcoin’s operation leverages the computational strength of all network devices, recognized as mining, to append fresh data to the blockchain, compensating miners with bitcoins for their efforts.

The inherent complexity of this system confers strong resistance against hacking attempts, as any assailant would need to grab control of 51% or more of the network’s computational strength to compromise it.

Subsequently, Ethereum emerged on the blockchain scene, introducing smart agreements that greatly expanded its usefulness for numerous company needs, specifically in financial markets.

In the area of real-world financial services, blockchain boasts a plethora of applications. A 2017 report by PWC disclosed that 77% of fintech companies anticipated combining blockchain into their systems. Forbes, in its 2022 overview of the 50 most noteworthy projects, featured several within the fintech sector.

Ready to adopt the upcoming of finance? Learn how fintech blockchain solutions can change your investments. Join the blockchain revolution in fintech. Explore our blockchain consulting company for the newest insights and opportunities!

Fintech companies are taking on this rising trend for many reasons, combining the following factors.

Resolve identity theft issues.

In 2017, Javelin’s press release reported that 6.64% of consumers fell victim to identity theft. Since then, the scenery of digital fraud and identity theft has grown increasingly treacherous, exacerbated explicitly by the difficulties posed during the pandemic.

In response to heightened scrutiny, banks and fintech companies now face stringent requirements mandating the implementation of know-your-client and anti-money laundering procedures. However, compliance necessitates large-scale paperwork, a significant bottleneck in their operational processes. Verification processes can stretch over weeks, plagued by the burdensome and non-standardized nature of the paperwork involved.

Consequently, financial institutions are increasingly embracing the implementation of a blockchain-based system. This innovative system wants users to establish their identity solely once. Subsequently, they receive a verification document allowing them to perform transactions globally. Moreover, this document enables individuals to oversee and share their data, facilitate password-free logins, and e-sign any necessary documents.

Global payment options

The blockchain network runs totally on the internet without specific setups. Thanks to digitizing assets, users can employ their account’s public and private keys to enter data and perform transactions anywhere in the world.

This internet-centric system offers extraordinary flexibility for global transactions. Notably, a 2016 Statista study examining blockchain usage possibilities within financial institutes uncovered that approximately 60% of all blockchain-based digital asset transfers were loyal to cross-border transactions.

Decrease transaction costs

In the area of online transactions, a multitude of elements requires consideration. These transactions integrate trading companies or applications, move channels, and the existence of intermediaries, which often downturn the procedure and launch extra charges into the process. The complexity and costs escalate, specifically when dealing with international transactions.

According to a McKinsey study, remittance companies bring in a staggering $40 billion annually from these imposed fees. The transformative possibility of blockchains is evident in this context. Blockchains facilitate direct peer-to-peer (P2P) online transactions. It is blocking the need for intermediaries and their joined expenses. The decentralized nature of this system not only stops payment postpones but also enables real-time data updates. It guarantees seamless, error-free operations while stopping unwarranted charges and safeguarding investments.

Financial instruments trading

This case is not primarily about cryptocurrencies and NFTs as investment options. Instead, it focuses on the transformative influence of blockchain networks, often of the private company variety, on the trading of financial assets. This process necessitates approvals, the establishment of audit trails, and attainability for numerous pre-verified roles, like financial brokers and advisors.

Traditionally, each participating unit independently performs these tasks. However, blockchain caters to a unified virtual platform where these companies converge, promoting complete accountability and openness in all actions. Implementing blockchain solutions for financial clearing services has proven highly effective, decreasing processing times and mistake rates by more than half.

Invest or achieve budget via Lending.

For certain businesses, the conventional avenues of accessing credit and loans remain out of reach despite the need for sufficient cash flow to facilitate expansion and operational efficiency. This difficulty is specifically suitable for fintech startups and e-commerce enterprises. Conversely, small teams of investors seek possibilities for hassle-free and low-risk investment options.

Blockchain tools, notably smart contracts, exhibit an innovative solution to interconnect personal borrowers with investors. This technology offers a means to move assets, establish transparent contractual terms, and automate debt management and execution. The blockchain efficaciously mitigates risks for either party involved, extending possibilities to investors and borrowers often overlooked within the confines of the traditional financial system.

Greater regulation and auditing

As global financial connectivity continues to surge, there is a parallel rise in the request for regulatory services. To meet this escalating demand, companies are increasingly turning to progressed fintech systems, where blockchain solutions come into play.

Blockchain applications function through a decentralized system that generates fresh storage regions for each latest action while preserving the integrity of older blocks. They also preserve an immutable record of all transactions joined with your blockchain, as well as the original documents of the trades, reachable to users at any given time.

Furthermore, blockchain consolidates all data and analytical reports into a single, effortlessly reachable source, greatly facilitating the auditing process. Its smart, read-only nodes considerably decrease the time and cost necessary for verification and accounting purposes.

Credit reports

Banking and financial institutions routinely keep their users’ transactional data to perform monthly transaction analyses, evaluate customer credibility, and prepare credit reports. However, this is typically executed through a centralized server or system, which poses a significant security risk. Unauthorized entry to the server can compromise the private data of all users.

Blockchain-based systems give a marked departure from this conventional approach, providing heightened reliability. They disperse data across separate storage spaces, efficaciously safeguarding the information. These systems also employ strong security algorithms and identity verification protocols to fortify security measures.

A notable benefit lies in the expeditious auditing abilities of blockchain systems for credit reports, outperforming traditional systems by a significant margin.”

Conclusion

Blockchain’s influence on the fintech sector is nothing short of avant-garde, transmuting the finance sector in profound ways. The benefits of blockchain technology are unmistakable, as it removes barriers to speed, cost, and multiple other factors governing financial transfers. Fintech blockchain solutions give real-time database management, streamlined financial tracking, efficient resource management, and more.

Moreover, this cutting-edge technology can raise the security standards of financial institutions, serving as a strong defense against identity theft and joined issues. Recognizing these benefits, vital banks like HSBC, Deutsche Bank, and KBC have kept blockchain to enhance the reliability of their services.

Blockchain platforms represent the upcoming of finance, catering not solely to cryptocurrency users but also to the broader scenery of FIAT currencies, a trend propelling significant company growth. Consequently, multiple organizations are energetically seeking ways to make use of blockchain’s abilities to turn into integral participants in this transformative landscape.

Get the best blockchain strategy professionals from Sky Potentials US to make over your financial operations within the fintech firm, whether secure payments, faster settlements, or more extraordinary audit trails and data traceability. We have the most trained and experienced software systems developers in the US.

As a leading blockchain consulting company, we are here to lead your fintech firm with innovative ideas and aggressive strategies.